Housing Inventory – what happens at zero?

Supply and demand. When supply is low and demand is high, the prices go up. That is simple economics we learned in school.

Supply is zero. I just looked it up and in some areas I’m working in, supply is zero.

Odd things happen with numbers when you start working with zero as one of them. Divide by zero and you get ‘infinite’ as an answer. Now, it’s not zero everywhere and in all price ranges but it is zero around Buford, GA up to about $400,000. Keep in mind there are sales happening in those areas even though inventory says zero, they are selling so fast that some of them are not getting counted in the numbers that get updated monthly.

We measure inventory in months. How many months of inventory do we have? A balanced market is traditionally said to be 6 months of inventory but right now we see it last only a few days so the sellers are in the catbird seat. They can almost name their price and the comps don’t matter as much as they did even a few months ago.

Why is this true?

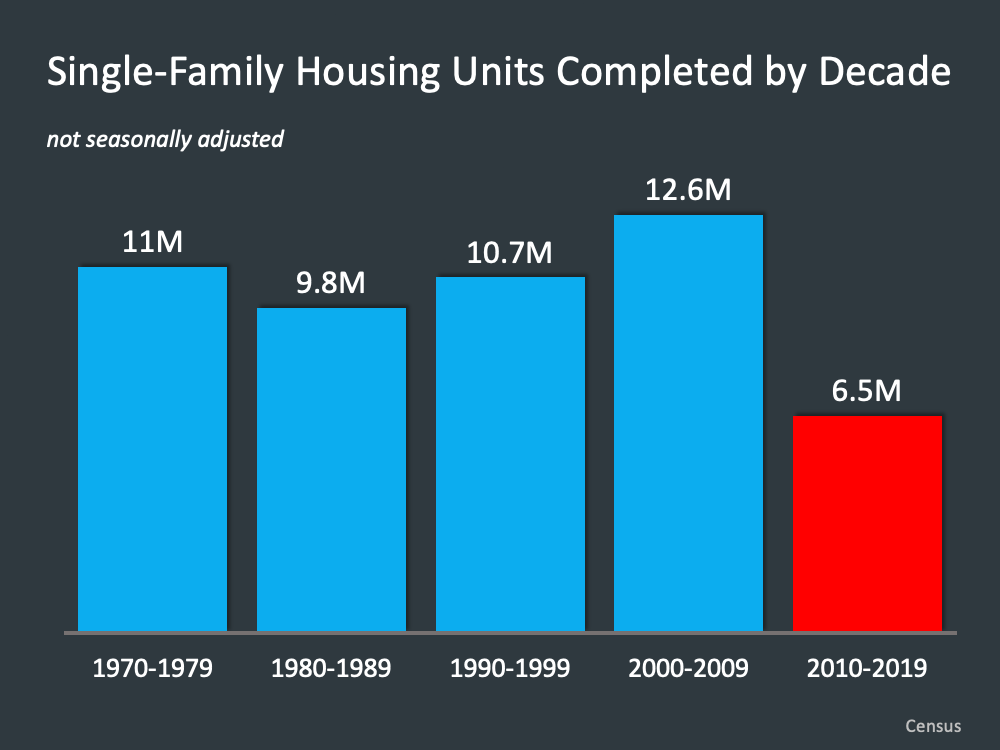

In the Atlanta market (and nationally really) the builders have been behind since the crash in 2008. Back then we had a lot more inventory than we needed and it just sat, causing the builders to go under or pull back so much they could not catch up. We’ve been there for about 10 years. A decade.

The chart above shows this with about half as many new builds being done as we need.

The second thing that happened in Atlanta and a few other markets is the institutional rental investors (hedge funds) bought up the low-priced inventory in 2008-2012 for about a 40% discount and turned it into rentals. These houses are currently cash cows and they don’t intend to let them go anytime soon.

In one Atlanta zip code, they bought almost 90 percent of the 7,500 homes sold between January 2011 and June 2012; today, institutional investors own at least one in five single-family rentals in some parts of the metro area (The Atlantic)

I’ve been talking to builders and at the moment, many of them are holding off on writing new contracts. They are 9-12 months behind, can’t predict the cost of materials, and are building as fast as they can.

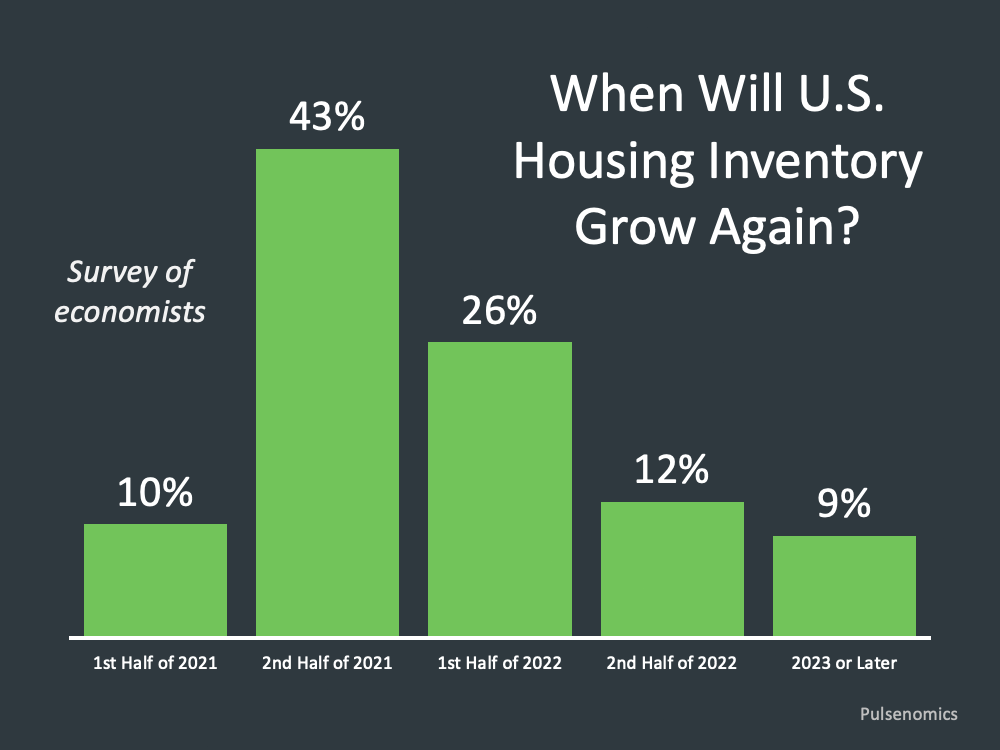

So, how long will this last?

Lots of folks think we’re going to see an increase in inventory later this year and I’d agree. It’s going to take some time for the builders to get on track but once they do it will snowball with move up and downsizing buyers who have a house to list. Millennials who decided to buy a house instead of avocado toast are going to be buying more too so it might take a bit longer as they go back to work, post pandemic but it’s coming.

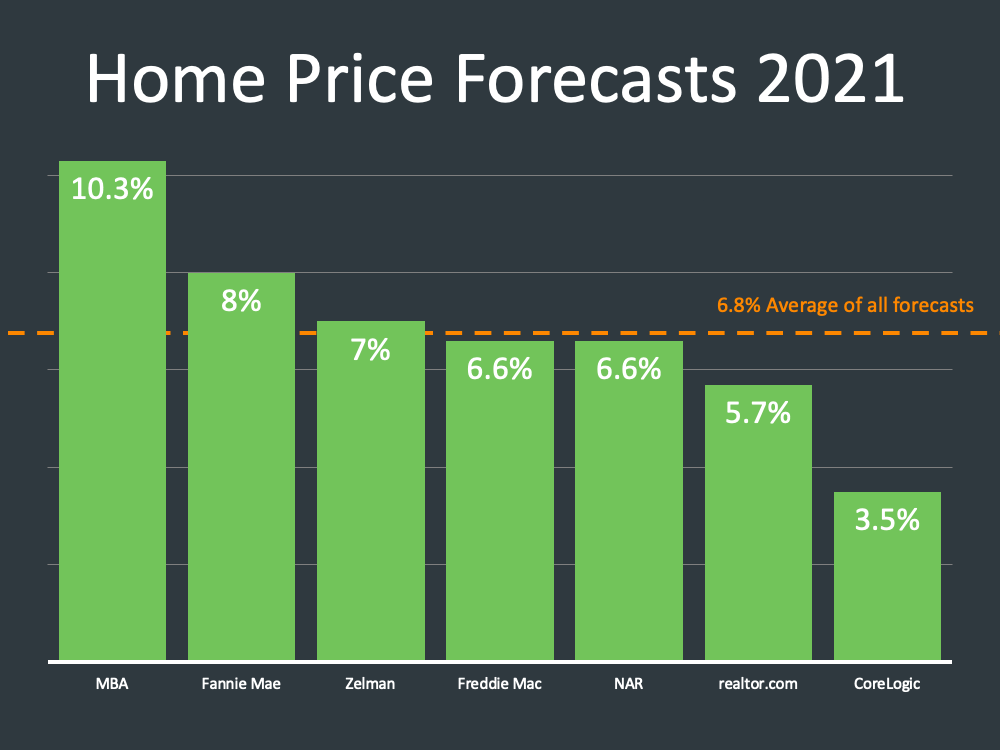

So what are housing prices expected to do? Is it going to crash?

I’d say probably not. Most sources say we continue to see appreciation with an average of 6.8% when you look at all the numbers. We are seeing the number of forbearances fall, the number of defaults (prior to foreclosure) fall, and homeowners have more equity in their homes than ever before. It’s not 2008 all over again! We just have a bump in this road and my advice to agents is to get educated and show your clients their upside of getting in the market now if they are buyers and make sure your sellers have a place to go once you light the fuse on their listing.

We have lots of tools to help if you are a consumer looking at this data and we can answer your questions. Pick up the phone and call me.

Thanks for listening,

Jerry Robertson

678-231-1578 Cell